PORTFOLIO

Overview

Formed in 1970 Big Rock Equities team has successfully acquired and disposed of more than 70 commercial real estate assets including more than 20,000 multifamily units over the past 50 years.

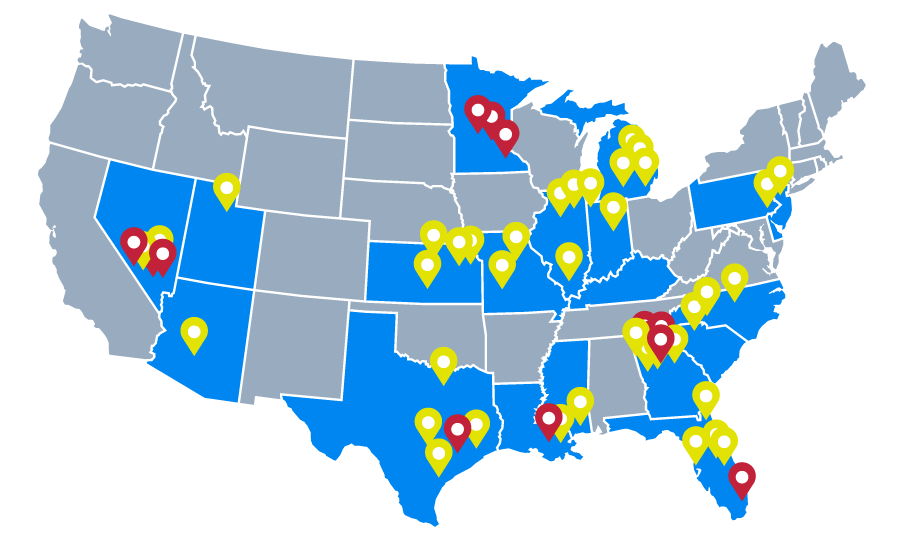

Big Rock Equities’ historic portfolio has included:

‣74 Properties;

‣19 States;

‣55 Unique Submarkets.

- Sold Asset

- Current Asset

CURRENT STORAGE Portfolio

ILLINois

ExtraSpace Storage

Bolingbrook, IL

GEORGIA

COMING SOON

Lawrenceville, GA

CURRENT HOTEL Portfolio

louisiana

Holiday Inn

Baton Rouge, LA

Crowne Plaza Executive Center

Baton Rouge, LA

TEnnessee

Crowne Plaza

Knoxville, TN

CURRENT MultiFamily Portfolio

Georgia

Arbor Gates at Buckhead

Atlanta, GA

Aylesbury Farms

John's Creek, GA

Charleston Court

Atlanta, GA

Clarinbridge

Kennesaw, GA

Minnesota

The Boulders

Rochester, MN

Carriage Oaks

Blaine, MN

Colonial Estates

Coon Rapids, MN

Nevada

LaVilla Estates

Las Vegas, NV

San Tropez

Las Vegas, NV

Silver Stream

Las Vegas, NV

Texas

Nottingham Place

Katy, TX

Florida

The Grove at Turtle Run

Coral Springs, FL

Louisiana

The Regent

Baton Rouge, LA

Case Studies

Capitalizing on Strong Demographics with Accretive Improvement Plan

Property Location: Cary, North Carolina

Property Size: 302 units

Acquisition Year: 2004

Disposition Year: 2017

Realized IRR: 21.6%

Realized EM: 9.1x

Title

-

NOI

-

Average Unit Rent/Mo.

2004

-

$1,513,576

-

$613

2017

-

$2,485,295

-

$1,047

CAGR

-

3.9%

-

4.2%

• Big Rock Equities Team recognizes outsized population & employment growth in Wake County.

• Brook Arbor sourced through established acquisition network.

• Acquire Property in 2004 for $25,450,000.

• Washer & dryer installation program implemented in 2005, yielding a 62.0% ROIC.

• Interior unit upgrades inclusive of stainless steel appliances, new cabinetry, flooring, lighting and hardware completed on 40.0% of the units throughout 2015-2017.

• Accretive capital improvements financed entirely with debt upsizing.

• With remaining value-add to be realized and value-add capital flows migrating to the Research Triangle, the Property sold for $54,500,000 ($180,464 per unit).

• The sale generated a 21.6% IRR and a 9.1x equity multiple for investors.

Case Studies

Rescue Capital Deployment into Devastated Market

Property Location: Baton Rouge, LA

Property Size: 264 units

Acquisition Year: 2005

Disposition Year: 2010

Realized IRR: 38.6%

Realized EM: 4.4x

• Built in 1998, Mansions was severely mismanaged and capital starved. Occupancy was just 92% at the time of acquisition.

• Hurricane Katrina, with total economic costs of $161 billion, devastates Louisiana in August of 2005, driving 500,000 displaced New Orleans residents to Baton Rouge.

• Capitalizing on unprecedented market dislocation, Big Rock Equities purchased the asset for $22,600,000 shortly after the storm.

• Immediate repair of Katrina induced damage.

• $800,000 accretive capital investment plan, comprised of clubhouse expansion, washer-dryer installation, and fitness center retrofit completed.

• Occupancy raised to +96.0% in tandem with mark-to-market rental rate increases across all units.

• Notwithstanding the global financial crisis, Louisiana’s remarkable Katrina recovery was a major contributor to the submarket’s cap rate compression.

• Disposition cap rate of 7.4%, representing 175 bps of compression.

• Asset sold for $27,317,500.